Question: What is the purpose of the Electronic Funds Transfer Act quizlet?

Electronic Fund Transfer Act. It is intended to protect consumers engaging in all forms of electronic fund transfers. The main point we need to remember is we cannot REQUIRE a consumer to allow us to Debit, ACH or otherwise without consent.

- What is the purpose of the Electronic Funds Transfer Act?

- What is the purpose of the Fair credit Reporting Act and the Electronic Fund Transfer Act?

- What is electronic funds transfer and how does it work?

- What is the purpose of the electronic Funds Transfer Act quizlet?

- What is the purpose of Regulation H and what act does it implement?

- What is the purpose of credit legislation and its impact on individuals companies and financial institutions?

- Why was the Fair Credit Reporting Act created?

- How does the Fair Credit Reporting Act protect consumer rights?

- How do I set up an electronic funds transfer?

- What is an example of an EFT?

- What is electronic Funds Transfer quizlet?

- What problem was the electronic Funds Transfer Act trying to help solve?

- What type of system is electronic funds transfer EFT quizlet?

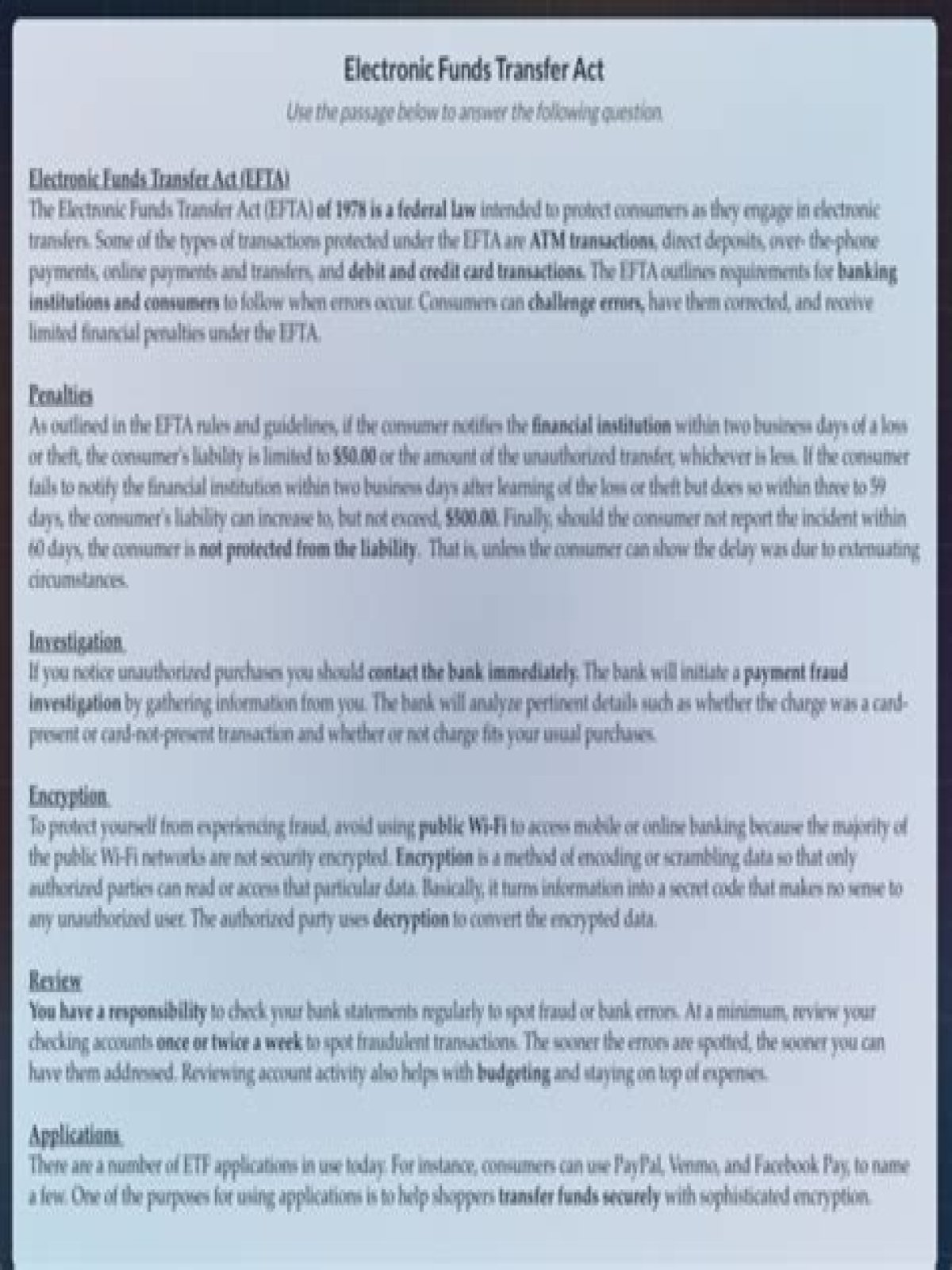

What is the purpose of the Electronic Funds Transfer Act?

The Electronic Fund Transfer Act (EFTA) is a federal law that protects consumers when they transfer funds electronically, including through the use of debit cards, automated teller machines (ATMs), and automatic withdrawals from a bank account.

What is the purpose of the Fair credit Reporting Act and the Electronic Fund Transfer Act?

The Fair Credit Billing Act (FCBA) and Electronic Fund Transfer Act (EFTA) establish procedures for resolving mistakes on credit billing and electronic fund transfer account statements, including: Charges or electronic fund transfers that you – or anyone you have authorized to use your account – have not made.

What is electronic funds transfer and how does it work?

What is electronic funds transfer? An electronic funds transfer moves money from one account to another electronically over a computerized network. EFTs require both the sender and recipient to have bank accounts. The accounts do not have to be at the same financial institution to transfer funds.

What is the purpose of the electronic Funds Transfer Act quizlet?

Electronic Fund Transfer Act. It is intended to protect consumers engaging in all forms of electronic fund transfers. The main point we need to remember is we cannot REQUIRE a consumer to allow us to Debit, ACH or otherwise without consent.

What is the purpose of Regulation H and what act does it implement?

The purpose of Regulation H is to enhance consumer protection and reduce fraud by directing states to adopt minimum uniform standards for the licensing and registration of residential mortgage loan originators and to participate in a nationwide mortgage licensing system and registry database of residential mortgage

What is the purpose of credit legislation and its impact on individuals companies and financial institutions?

Its purpose is to protect consumers obtaining credit to finance their transactions, ensure that adequate credit is provided, and govern the credit industry in general. In 1968, Congress passed the Consumer Credit Protection Act in part to regulate the consumer credit industry.

Why was the Fair Credit Reporting Act created?

The Fair Credit Reporting Act (FCRA) was enacted to promote accuracy, fairness, and the privacy of personal information assembled by credit reporting agencies.

How does the Fair Credit Reporting Act protect consumer rights?

The FCRA gives you the right to be told if information in your credit file is used against you to deny your application for credit, employment or insurance. The FCRA also gives you the right to request and access all the information a consumer reporting agency has about you (this is called “file disclosure”).

How do I set up an electronic funds transfer?

Configure the Bank Account to allow EFT:

- On the navigation bar, click Banks.

- Select the appropriate bank account from the Select a bank account drop-down menu.

- Click Edit account details and then select the Payments tab.

- Mark the Allow?

- Select the appropriate EFT form from the Default form drop-down menu.

What is an example of an EFT?

Electronic funds transfer (EFT) refers to an electronic financial transaction. Examples of common electronic funds transfer transactions include the following: Automatic teller machines (ATM) Direct deposit payroll systems.

What is electronic Funds Transfer quizlet?

Electronic Funds Transfer (EFT) is a method of automating the payment process. EFT allows businesses to conduct financial transactions electronically. It is an Automated Teller Machine which gives you money from your checking account. To use it you need a PIN number which you should NEVER give away.

What problem was the electronic Funds Transfer Act trying to help solve?

In 1979, the Electronic Fund Transfer Act (EFTA), also known as Regulation E, was implemented to protect consumers when they use electronic means to manage their finances.

What type of system is electronic funds transfer EFT quizlet?

-Electronic Funds Transfer (EFT) System is a disbursement system that uses wire, telephone, telegraph, or computer to transfer cash from one location to another.