What is FICA WH on my paycheck?

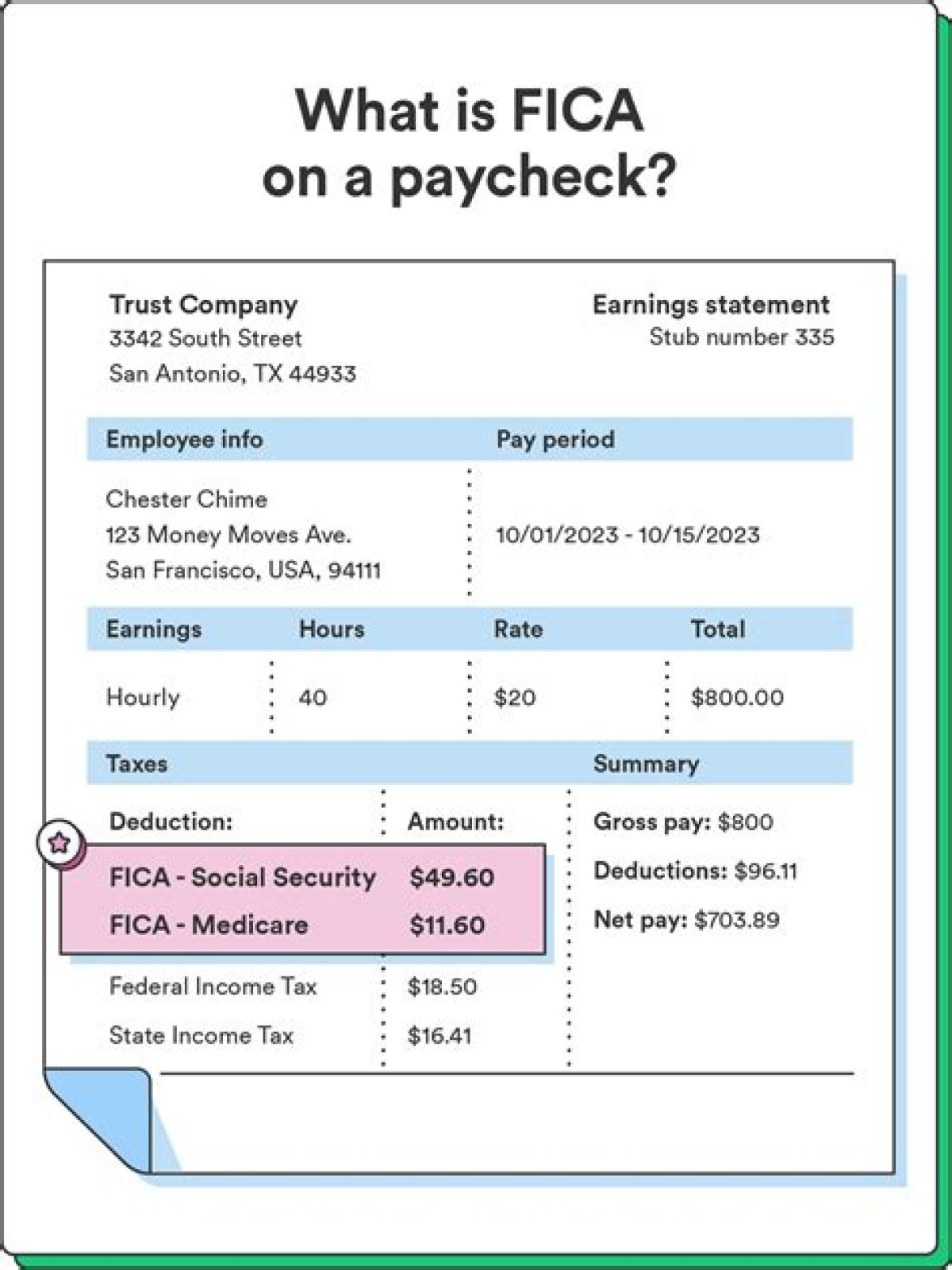

FICA is an acronym for “Federal Insurance Contributions Act.” FICA tax is the money that is taken out of workers’ paychecks to pay older Americans their Social Security retirement and Medicare (Hospital Insurance) benefits. It is a mandatory payroll deduction.

What are two types of payroll taxes?

In terms of examples of a payroll tax, there are a few different types of payroll taxes: Federal Insurance Contributions Act Tax (FICA) Federal Unemployment Tax Act (FUTA) State Unemployment Tax Act (SUTA)

How do I calculate the amount of FICA tax withholding?

This article provides a step-by-step guide to doing the withholding of FICA taxes. FICA taxes are taxes for Social Security and Medicare. The FICA tax is shared by employees and employers, so one-half of the tax is deducted from employee paychecks each payday.

What’s the difference between employer and employee FICA taxes?

Both halves of the FICA taxes add up to a total of 15.3%, broken down as follows: 1 Social Security employee contribution: 6.2% 2 Social Security employer contribution: 6.2% 3 Medicare employee contribution: 1.45% 4 Medicare employer contribution: 1.45% 2

What do you need to know about payroll taxes?

Write paychecks and distribute them to the employees. Get totals for payroll tax deposits. When you are finished with the payroll, you will need to get totals for all employees for (a) gross pay, (b) federal, state, and local withholding, (c) FICA taxes, and (d) any other deductions. You will need these amounts for payroll tax deposits and reports.

How are federal and state payroll taxes calculated?

Two payroll taxes, FUTA (Federal Unemployment Tax Act) and SUI (state unemployment insurance) are paid solely by the employer and based upon employees’ wages and other factors. There are three states where both the employer and the employee contribute to the unemployment tax: New Jersey, Pennsylvania and Alaska.