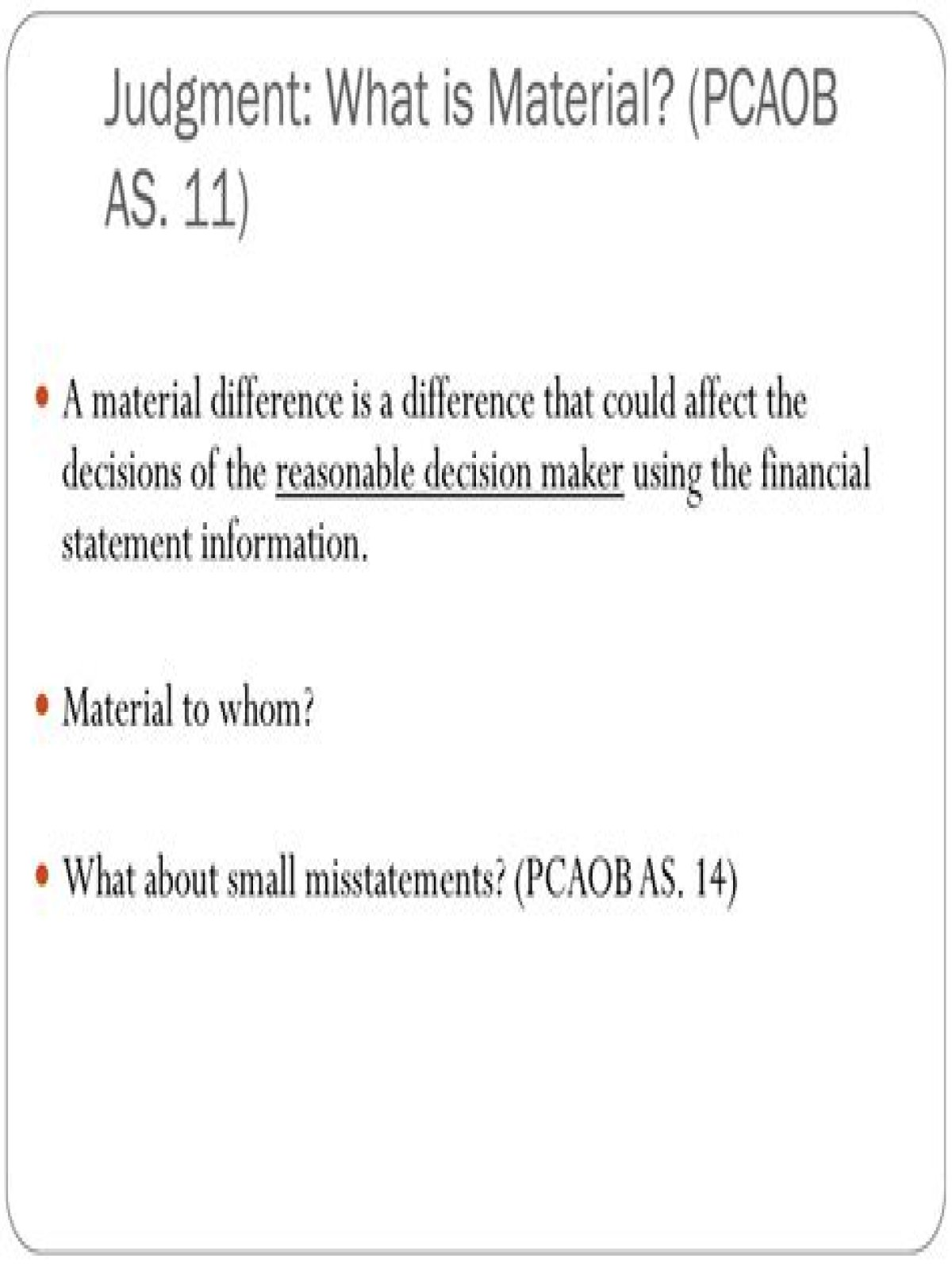

How does Pcaob define materiality?

How does Pcaob define materiality?

2, Qualitative Characteristics of Accounting Information, which defines materiality as “the magnitude of an omission or misstatement of accounting information that, in the light of surrounding circumstances, makes it probable that the judgment of a reasonable person relying on the information would have been changed or …

What is the standard for materiality?

The standard for materiality articulated by the Supreme Court — “an omitted fact is material if there is a substantial likelihood that a reasonable shareholder would consider it important in deciding how to vote” — benefits investors in at least three ways.

What is the threshold for materiality?

The materiality threshold is defined as a percentage of that base. The most commonly used base in auditing is net income (earnings / profits). Most commonly percentages are in the range of 5 – 10 percent (for example an amount <5% = immaterial, > 10% material and 5-10% requires judgment).

What are the three levels of materiality?

Three types of audit materiality include overall materiality, overall performance materiality, and the specific materiality. The auditor uses these as per the different situations prevailing in the company.

What is the materiality amount at an account level referred to as?

The preliminary estimate of materiality at the financial statement level, often called planning materiality, is the maximum amount by which the auditors believe the statements could be misstated, by known or unknown error or fraud, and still not affect the decisions of reasonable financial statement users.

What is materiality anthropology?

Materiality studies involve the exploration of the situated experiences of material life, the constitution of the object world and concomitantly its shaping of human experience. Angela Garcia explores the relationship between material and psychic life in both the United States and Mexico City.

How do you determine materiality?

How do auditors determine materiality? To establish a level of materiality, auditors rely on rules of thumb and professional judgment. They also consider the amount and type of misstatement. The materiality threshold is typically stated as a general percentage of a specific financial statement line item.

What are the 2 types of materiality?

Overall Materiality (for the Financial Report as a whole)

What is audit RJE?

RJE – Reclassifying Journal Entry.

How do you find unrecorded liabilities?

Search for Unrecorded Liabilities Examples

- Select a sample of payment transactions after year-end.

- Examine the selected payments with the supporting documents (e.g. suppliers’ invoices) to determine whether the liabilities were at the balance sheet date.

- Inquire the related personnel about any unrecorded invoices.

What is PCAOB audit?

The Public Company Accounting Oversight Board (PCAOB) is a Congressionally-established nonprofit that assesses audits of public companies in the United States to protect investors’ interests. The PCAOB also oversees broker-dealer audits, including compliance reports filed under federal securities laws.

What is planning materiality?

Planning Materiality. Planning Materiality is the materiality that identify and assess by auditors to financial statements at the planning stages of audit of financial statements. In practice, auditor use quantitative factors to assess the materiality of financial statements.

What is the materiality threshold?

Materiality thresholds are the dividing line between material and immaterial information. Recognition materiality thresholds are the dividing line between what is recorded and what is not recorded in the accounts.